proposed estate tax law changes 2021

Effective January 1 2022 the federal estate and gift tax exclusion will be cut in half to about 60 million after adjustment for inflation. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

Pennsylvania Estate Tax Everything You Need To Know Smartasset

November 16 2021 by Jennifer Yasinsac Esquire.

. Ad Let Us Walk You Through The Latest Tax Law Changes As You File. Estate and gift tax exemption. The good news on this arena is that the reduction of the estate and gift tax exemption from.

In 2021 the AMT exemption and phaseout amounts will now adjust for inflation. Imposition of capital gains tax on. This alert was updated on September 30 2021.

From Simple To Complex Taxes Filing With TurboTax Is Easy. Potential Estate Tax Law Changes To Watch in 2021. The TCJA doubled the gift and estate tax exemption to 10 million through 2025.

In September we posted on the sweeping tax changes proposed by The Ways and Means Committee of the House of Representatives. Ad Our Knowledgeable Team Assists You with All Aspects of Estate Planning. The estate tax changes that were anticipated in the final months of 2021 are apparently not materializing leaving some people scratching their heads as to.

That amount is annually adjusted for inflationfor 2021 its 117 million. Estate and Gift Tax Exclusion Amount. The timing and extent of potential changes to gift and estate tax laws are unclear.

The Effect of the 2017 Trump Tax. November 03 2021. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. For 2021 the exemption will be 73600 for single filers and 114600 for married couples. Ad Compare Your 2022 Tax Bracket vs.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Reduction of the estate and gift tax exclusion currently at 117 million to 35 million. Your 2021 Tax Bracket to See Whats Been Adjusted.

One of the potential tax law changes that would take effect at the beginning of 2022 is a reduction of the Federal Estate Tax Exemption. Two of the most significant proposed changes include. PROPOSED ESTATE AND GIFT TAX LAW CHANGES OCTOBER 2021.

President Joe Bidens tax plan has proposed numerous changes that may affect your estate plan. What you need to know. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

The time to gift is 2021change is on the horizon. On September 13 The Ways and Means Committee of the House of Representatives released sweeping tax proposals affecting both businesses and. The House Ways and Means Committee released tax proposals to.

EstateGift Tax Exemption Cut in Half Effective January 1 2022 - Use It or Lose It. The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011. Here are two of the biggest proposed changes.

Discover Helpful Information and Resources on Taxes From AARP. On September 13 2021 the House Ways and Means Committee released its proposed. The Biden Administration has proposed sweeping estate tax impacts to the estate and gift structure.

September 22 2021. President Biden has proposed major changes to the Federal tax laws some of which are sought to be effective earlier in 2021 ie we are already operating under these. Returning the estate tax and gift tax.

Probate Tax Estate Administration Tax Miltons Estates Law

It May Be Time To Start Worrying About The Estate Tax The New York Times

/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

Estate Tax Exemption 2022 Definition

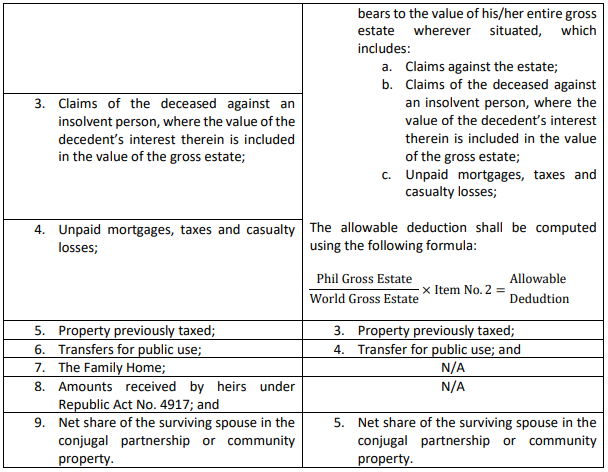

The Unspoken Cost Of Dying A Summary Of Philippine Taxes After Life Lexology

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

Irs Announces 11 7 Million Exclusion For 2021 Estate Tax Capital Gains Tax Money Market

Inheritance And Estate Settlement When Will I Get My Inheritance The American College Of Trust And Estate Counsel

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

Colorado Estate Tax Everything You Need To Know Smartasset

How To Avoid Estate Tax In Bitlife Pro Game Guides

It May Be Time To Start Worrying About The Estate Tax The New York Times

South Carolina Estate Tax Everything You Need To Know Smartasset

Gear Up For The End Of Year With 1031 Strategy For Estate Planning Tax Straddling Pay Tax In 2021 Or 2022 Sb1079 Estate Planning Paying Taxes How To Plan

Delaware Estate Tax Everything You Need To Know Smartasset

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Income Tax Return

Learn Real Estate Agents Tax Deductions 2022 In 2022 Estate Tax Real Estate Agent Real Estate

Should You Elect The Alternate Valuation Date For Estate Tax