reverse sales tax calculator california

This is especially important in case you want to figure the amount of Sales Tax you can claim when filing deductions. Please contact the local office nearest you.

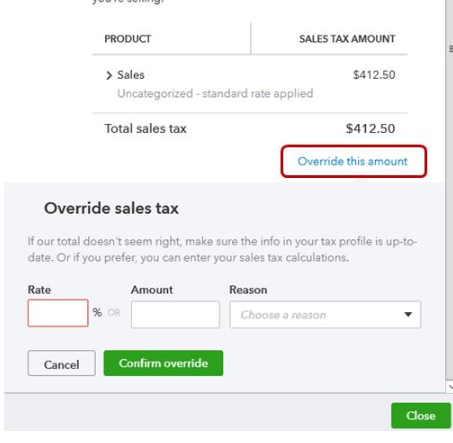

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Our income tax calculator calculates your federal state and local taxes based on several key inputs.

. For questions about filing extensions tax relief and more call. Not all products are taxed at the same rate or even taxed at all in a given. Most transactions of goods or services between businesses are not subject to sales tax.

The sales tax rate ranges from 0 to 16 depending on the state and the type of good or service and all states differ in their enforcement of sales tax. All other states have a rate of at least 40. If the rate is different add 100 to the VAT percentage rate and divide by that number Multiply the result from Step 1 by 100 to get the pre-VAT total.

For example if the full payment is 5798 and you paid 107 sales tax you can enter these numbers into our calculator to determine your original pre-tax price. Here is how the total is calculated before sales tax. Formulas to Calculate Reverse Sales Tax.

Amount without sales tax QST rate QST amount. Before Tax Price. Just fill the details of your income such as Salary House Property etc and get Other Details.

Home california reverse sales wallpaper. Your household income location filing status and number of personal exemptions. True tax Calculator 2005 is an Income tax calculator for the Assessment Year 2005-06 specially designed for Indian Income-Tax payers Individuals.

Businesses impacted by the pandemic please visit our COVID-19 page Versión en. California has a 6 statewide sales tax rate but also has 474 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2617 on top. Enter the sales tax percentage.

Home Top Free Apps. Sales Tax total value of sale x Sales Tax rate. The only thing to remember in our Reverse Sales.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. If you want to know how much an item costs without the Sales Tax you might want to calculate reverse Sales Tax. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to California local counties cities and special taxation districts.

Reverse Sales Tax Calculator Remove Tax. Reverse Sales Tax Computation Formula. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

Reverse sales tax calculator california Friday March 4 2022 Edit. Keep cutting the MAGI number by a few dollars at a time until line 11 of the calculator reports a monthly premium tax credit that is just barely higher than. Tax can be a state sales tax use tax and a local sales tax.

For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent. On March 23 2017 the Saskatchewan PST as raised from 5 to 6. PRETAX PRICE POSTTAX PRICE 1 TAX RATE Common Mistakes.

Thus you can compute the actual price and the sales tax charged on it out of a products post-tax priceThe formula for computing the actual sales price is easy. California is the state which has the highest tax rate 725. Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases.

Online videos and Live Webinars are available in lieu of in-person classes. Excludes tax tag registration title and dealer fees. CDTFA public counters are now open for scheduling of in-person video or phone appointments.

Often knowing the post-tax price in one municipality will provide little information of value to a person who is not subject to the same tax structures. This Sales Tax Calculator And De-Calculator will calculate sales tax from an amount and tax or reverse calculate with the tax paid. Here is the Sales Tax amount calculation formula.

If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737. See the article. Calculate net price and sales tax amounts.

Five states California Indiana Mississippi Rhode Island and Tennessee have rates equal or above 70. Tax rate for all canadian remain the same as in 2017. Pre Tax Price of Product Sale Price Post Tax Price 1 TAX RATE Have you checked California sales calculator.

Rather than calculating sales tax from the purchase amount it is easier to reverse the sales tax and separate the sales tax from the total. From there it is a simple subtraction problem to figure out that you paid 61 cents in sales tax. 52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you.

Sales tax calculator to reverse calculate the sales tax paid and the price paid before taxes. Current HST GST and PST rates table of 2022. That entry would.

Californias base sales tax is 725 highest in the country. Increasing Your Home S Value For Appraisal Refinance Mortgage Home Improvement Loans Second Mortgage What Is Boot In A 1031 Exchange Youtube Exchange One Piece Episodes Carrie Anne Moss. Amount without sales tax GST rate GST amount.

Take the gross amount of any sum items you sell or buy that is the total including any VAT and divide it by 1175 if the VAT rate is 175 per cent. See also the Reverse Sales Tax Calculator Remove Tax on this page. That means that regardless of where you are in the state you will pay.

Stripe Tax Automate Tax Collection On Your Stripe Transactions

How To Pay Sales Tax For Small Business 6 Step Guide Chart

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Sales Tax Reverse Calculator Internal Revenue Code Simplified

Reverse Sales Tax Calculator De Calculator Accounting Portal

California Sales Tax Calculator Reverse Sales Dremployee

Reverse Sales Tax Calculator Calculator Academy

Calculator With Sales Tax Sale Online 53 Off Edetaria Com

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Sales Taxes In The United States Wikiwand

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

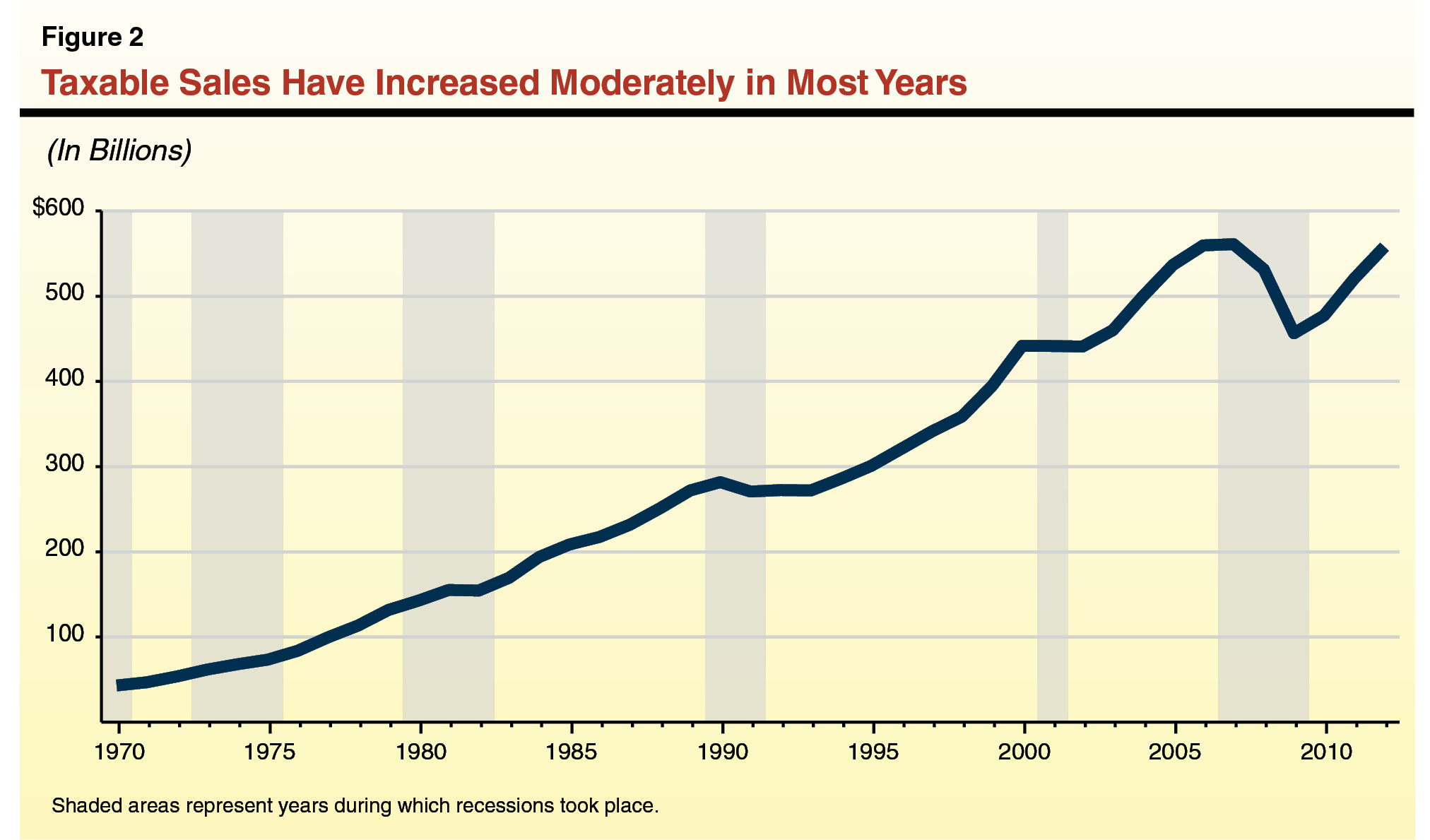

Why Have Sales Taxes Grown Slower Than The Economy

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

California Sales Tax Calculator Reverse Sales Dremployee